A qui profitent les profits ?

From the super-profits of the large companies in the CAC40 to the complete sale of Patagonia company to the Earth, no one has the same vision of what profits should be used for. So instead of limiting the debate to the opportunity or not of taxation, why not engage in a broader thinking on a new way of directing profits?

The debate is as old as the world but still remains a blind spot even though a number of models take this subject into account (for example, the mutualist model). The rule, in its simplified version, is that profits should first and foremost reward shareholders, because they have invested and taken risks and/or because the less you pay them, the less they will invest in your company. However, this idea is now coming up against fundamental changes, two of which are key:

- The climate emergency, which is accelerating divestments in a number of sectors (fossil fuels at the forefront) and starting a movement of shareholder accountability for the conditions and nature of their investments;

- The deeply political nature of the company, which leads it, de facto, to invest in a number of issues that go far beyond its simple economic purpose: fair remuneration of employees, equal opportunities, training and skills transfer, environmental impact, defense of human and social rights wherever it operates, etc.

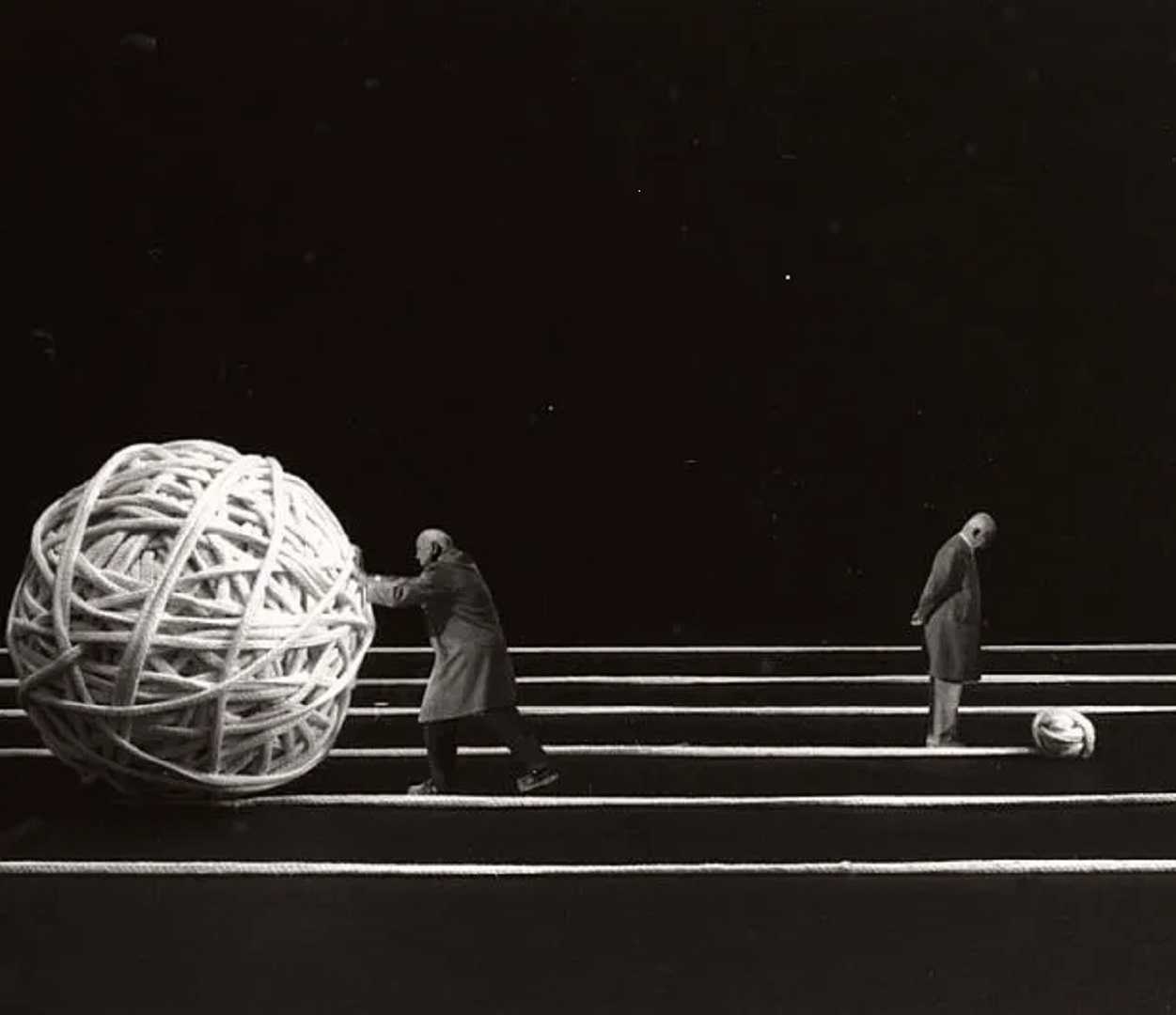

“The real issue is to know what and who profits are useful for.”

Behind this debate on the reorientation of profits, a major issue is looming that will be crucial in accelerating the shift towards a more sustainable model: the questioning of shareholder capitalism and its shift towards stakeholder capitalism. Stakeholders are increasingly questioning the meaning of work and the principles that companies set for themselves.

Beyond the issue of taxation, there is a more structuring issue to be preempted in order to change the models: the real issue is to know what and who profits are useful for, where the company is intended to reinvest them to contribute to the common good, and what limits shareholders should set for themselves in their quest for return on investment.